Financial Supply Chain Management (FSCM)

Let’s Talk!

Overview

The supply chain is a vital part of any business and all businesses require tools that help them oversee financial processes within the supply chain. SAP FSCM or SAP Financial Supply Chain Management is a prominent element of SAP that manages the financial aspect of the SCM for a business.

There are various functionalities within the FSCM. These include credit management, dispute management, and risk management, among others. Also, FSCM empowers companies to streamline and enhance their financial performance through SAP FSCM.

Moreover, the tool facilitates businesses with monitoring cash flows, managing receivables, and making concrete decisions. All these factors make it imperative for any business to grasp the power of SAP FASCM.

Here is all that we shall cover in this post:

- Modules in FSCM

- Things to consider while implementation

- How BPX will help implement?

- FAQs

Modules in FSCM

SAP FSCM is a vast system that comprises many modules. Each module of FSCM addresses a significant aspect of the financial processes within the supply chain.

Let’s take a quick look at the key modules in the SAP FSCM system.

Credit Management

This module is associated with assessing credit risk. It also monitors the creditworthiness of clients of a business. Other factors that can be determined with the help of this module are:

- Determining credit limits

- Evaluation of payment behavior

- Management of credit risk

Collections Management

This module concerns managing customer receivables and creating collection strategies. Here are some key areas this module helps companies with:

- Automating dunning process

- Creating collection strategies

- Monitoring collection performance

Treasury and Risk Management

Cash and liquidity management are taken care of with the help of this module. It also helps in forecasting cash flows and completing treasury transactions. This module also helps with optimizing the following criteria:

- Cash positions

- Forecast cash flows

- Manage financial risk

- Execute treasury actions

Dispute Management

This is the module that helps keep track of customer disputes. All resolutions of disputes are handled by this module. Any kind of customer disputes that are related to payments or invoices are handled through the Dispute Management module.

Biller Direct

It is a module that facilitates the customers in taking self-service actions. Through this module, customers can easily pay invoices and access other information. The Biller Direct module primarily offers a web-based portal for customers.

This portal makes it convenient for customers to view and access various important aspects related to their financial data.

Biller Direct module facilitates the customers with the following:

- Viewing and paying their invoices

- Manage disputes

- Access relevant financial information

In-House Cash Management

All sort of cash flow alliance and optimization takes place through this module. Fundamentally, it offers an interface for payments between companies. It is also instrumental in reducing external borrowing.

Here are certain elements the In-House Cash Management module of FSCM helps businesses:

- Facilitates inter-company payments

- Cash pooling

- Cash concentration to centralize liquidity

- Reduce external borrowing

Being a part of the SAP FSCM, all these modules work towards ensuring a smooth financial process. Besides, they bring a strong focus on reducing risk and strengthening financial supply chain management in an organization.

Things to Consider While Implementation

If you are contemplating implementing SAP FSCM in your company, then there are a few considerations that you should learn about.

Business Objectives

Evaluate and understand your business goals clearly before you begin to implement FSCM. Ensure that your goals include factors such as improving cash flow and reducing credit risk. If streamlining collections and elevating customer happiness is among the goals, then you should certainly consider implementing SAP FSCM for better output.

Data Integration and Migration

Take into consideration your existing systems and how the data will be integrated between them and FSCM. This stage requires strategies that will facilitate data integration and migration with ease.

Identifying and Assessing Implementation KPIs

Here, the team must define the KPIs to evaluate the efficiency of the FSCM implementation.

Stakeholder Engagement

This requires the company to involve its stakeholders from different departments. Active participation from the finance and IT teams, for example, is recommended. A higher number of stakeholders can provide more insights. This could eventually lead to a smoother transition.

Continuous Improvement

Companies must understand that implementing FSCM is an ongoing process. It can be a lengthy procedure and therefore, they must establish mechanisms to gather user feedback. This will help them implement changes for improvements in the system.

How will BPX Help Implement SAP FSCM?

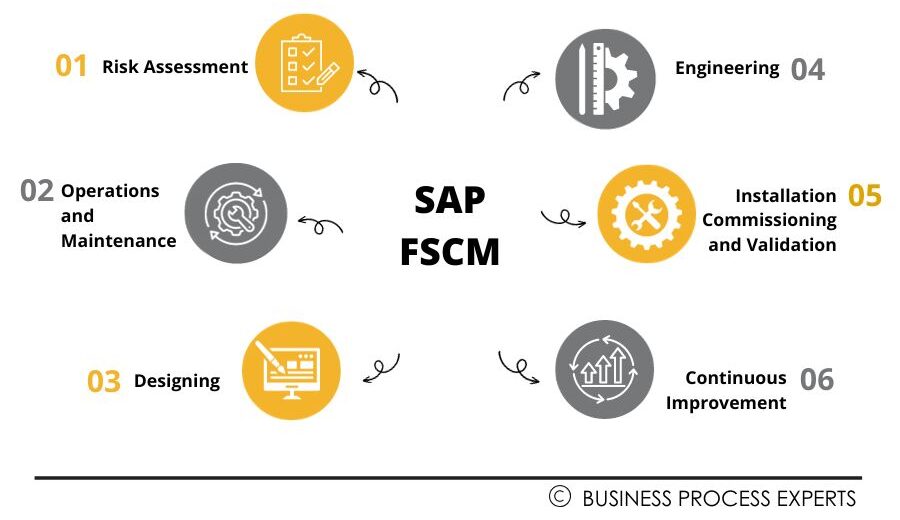

BPX strives to lay the foundation of a strong and ideal SAP FSCM system for efficient financial operations. This section entails the steps that BPX will take to carry out a smooth implementation.

1. As-Is Process

This process refers to the stage where BPX will be identifying the existing state of the financial supply chain on the client. BPX then analyzes the state of credit management, dispute resolution, and other processes. By doing so, it can identify the gaps that must be covered.

To summarize, BPX assists in implementing an ideal and optimized To-be process for SAP FSCM.

2. Business Blueprint (Gap-Fit & To-be)/ SAP functional specification document

During this stage, BPX takes steps to define the organization’s future course of action. All documentation pertaining to the business requirements and system configuration combines into a comprehensive business blueprint.

The blueprint is the fundamental roadmap with regard to the implementation of the system. This stage is crucial for developing strategies that could finalize an optimally-performing system.

3. Master Data Migration/ Item Master Configuration

At this stage, BPX focuses on transferring the current master data into the FSCM system. The steps could be elaborate such as:

- Extraction of data

- Cleansing

- Transforming data from legacy software

The role of BPX is to draw strategies for data migration. It also chalks out data mapping rules. Overall, it ensures a seamless migration process.

4. System Configuration / Realization (as per To-Be) along with customization

Complete customization of the data is achieved to align with the specific requirements. BPX ensures that the configuration emerges successfull based on the industry standards for effective financial supply chain management.

The process entails configuring settings, parameters, and rules within the FSCM modules.

5. UAT

User Acceptance Testing or UAT involves end-users who validate the efficacy of the new system. BPX facilitates this comprehensive testing by creating test scenarios for generating feedback in case of discrepancies.

With a holistic testing environment in place, BPX validates business processes and offers feedback on any issues. The entire process is aimed at bringing the system the closest to the required functionality of the business. In short, all arrangements are made to enable the effective usage of SAP FSCM before the final deployment.

6. Go-Live Preparation (update as per feedback during UAT)

Here, the team BPX prepares for the final deployment of the SAP FSCM. Being the preparation stage, BPX finalizes system configurations and also undertakes the following actions:

- Conducting user training

- Creating documentation

- Setting up system monitoring and backup process

- Performing data validations

All these actions are undertaken with the goal of executing a flawless transition from the testing phase to the live production environment. This way, any disruptions can be eliminated and the benefits of the SAP FSCM system can be maximized.

7. Go-Live

During this stage, BPX finally deploys the system configured. Now, the system is ready for use by real users and with real-time data.

8. After Go-Live Support

BPX extends support after the system has gone live. All concerns and issues regarding the performance of the system are addressed and resolved.

FAQs

FSCM stands for Financial Supply Chain Management. It is a component of SAP that optimizes financial procedures in the organization’s supply chain. With various modules, the system aims at bringing the financial operations of a company on one page; thus, maximizing the profitability of the business.

Promise to Pay is an agreement between the creditor and debtor which says that the debtor will repay the outstanding debt in the agreed timeframe. FSCM enables companies to keep track of such commitments by customers. In other words, it helps companies improve cash flow and collections management.

The Credit Limit Request is a process in FSCM that evaluates the credit limit for a customer. In simple terms, it is a procedure to assess the creditworthiness of a customer. It is a significant process that assists companies in managing credit risk and deriving informed decisions with regard to fixing credit limits for customers.